Access Payment Integrations: Log in to your payment provider dashboard and navigate to the integrations.

Enable BNPL: In the payment providers section, ensure that BNPL options like Klarna and Afterpay are enabled.

Important: Make sure your stripe account is enabled to use these payment methods.

Create an Invoice: Use your invoicing tool to generate a new invoice for your customer.

Send the Invoice: Send the invoice to your customer as you normally would.

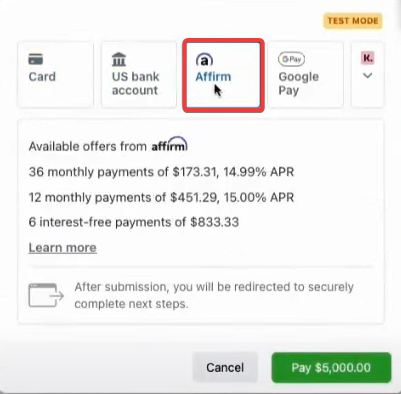

Open the Invoice: When your customer receives the invoice, they will open it to view the payment options.

Select Payment Method: The customer will see the standard payment methods, such as card or bank transfer, along with BNPL options like Klarna and Afterpay.

.png?alt=media&token=244def7d-ae06-4846-bfc4-0facd64c71f3)

Choose BNPL: The customer can select a BNPL option to defer their payment.

Follow BNPL Instructions: The customer follows the prompts to complete their purchase using the chosen BNPL service.

Confirm Payment: Once the payment is processed, you will receive confirmation, and the payment will be recorded in your system.

Verify Eligibility: Before enabling BNPL, verify that your business type is supported by the BNPL providers.

Monitor Settings: Regularly check your payment settings to ensure BNPL options are correctly configured.

Customer Communication: Clearly inform your customers about the availability of BNPL options on their invoices to increase adoption.

Businesses can benefit from BNPL by offering flexible payment options that encourage customers to pay their invoices more promptly, thus improving cash flow.

By providing BNPL options, you can attract more customers who might be hesitant to pay the full amount upfront, leading to increased sales and customer satisfaction.

Offering BNPL adds convenience for your customers, allowing them to manage their finances better and fostering a positive relationship with your business.

A: Fees for using BNPL services may vary by provider. Check with your payment provider for specific details on any associated fees.

A: Yes, you can disable BNPL options by accessing your payment settings and turning off the specific BNPL services you do not wish to offer.

A: Yes, BNPL can be used for both one-time and recurring invoices, providing flexibility for various billing scenarios.