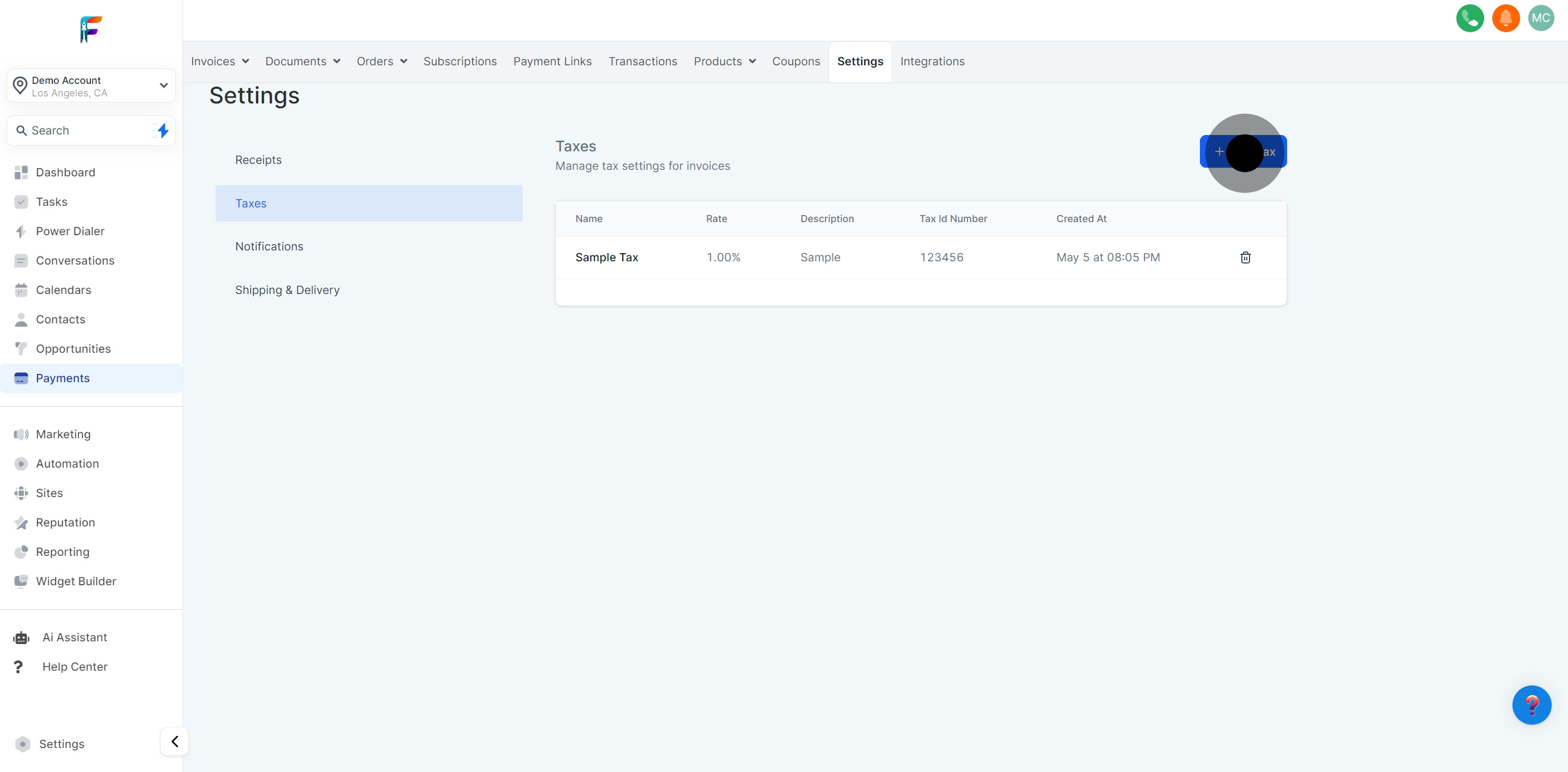

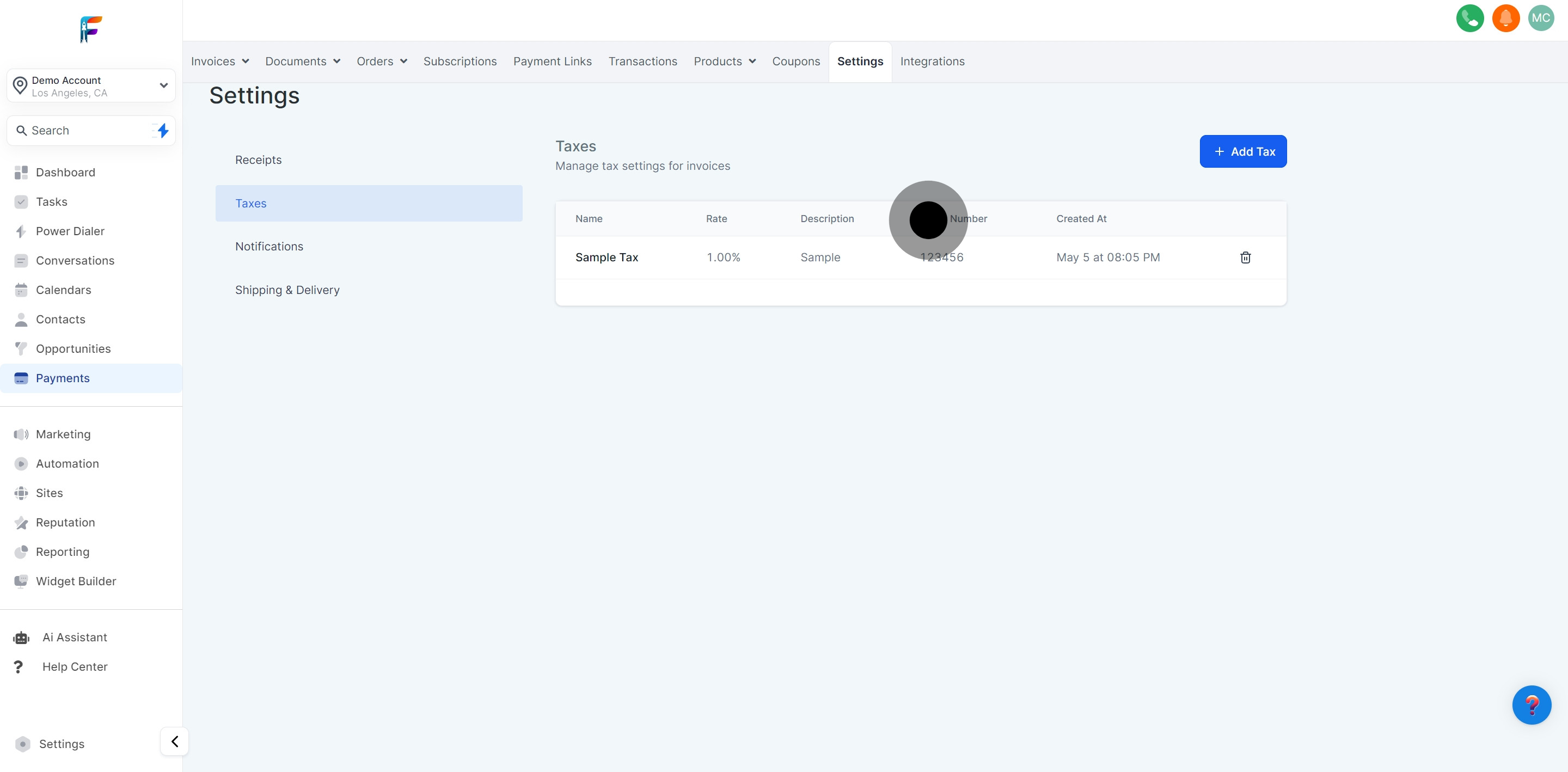

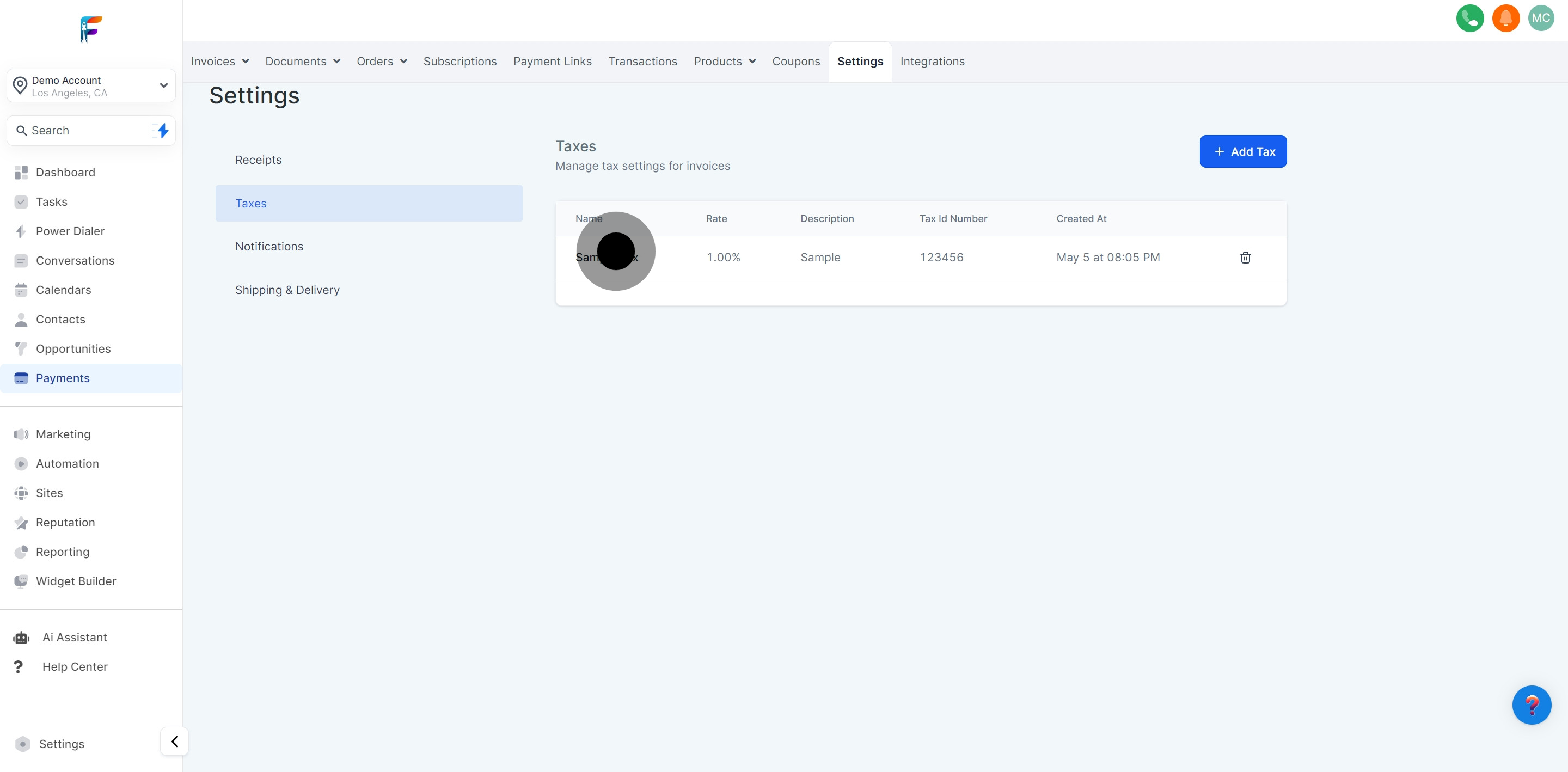

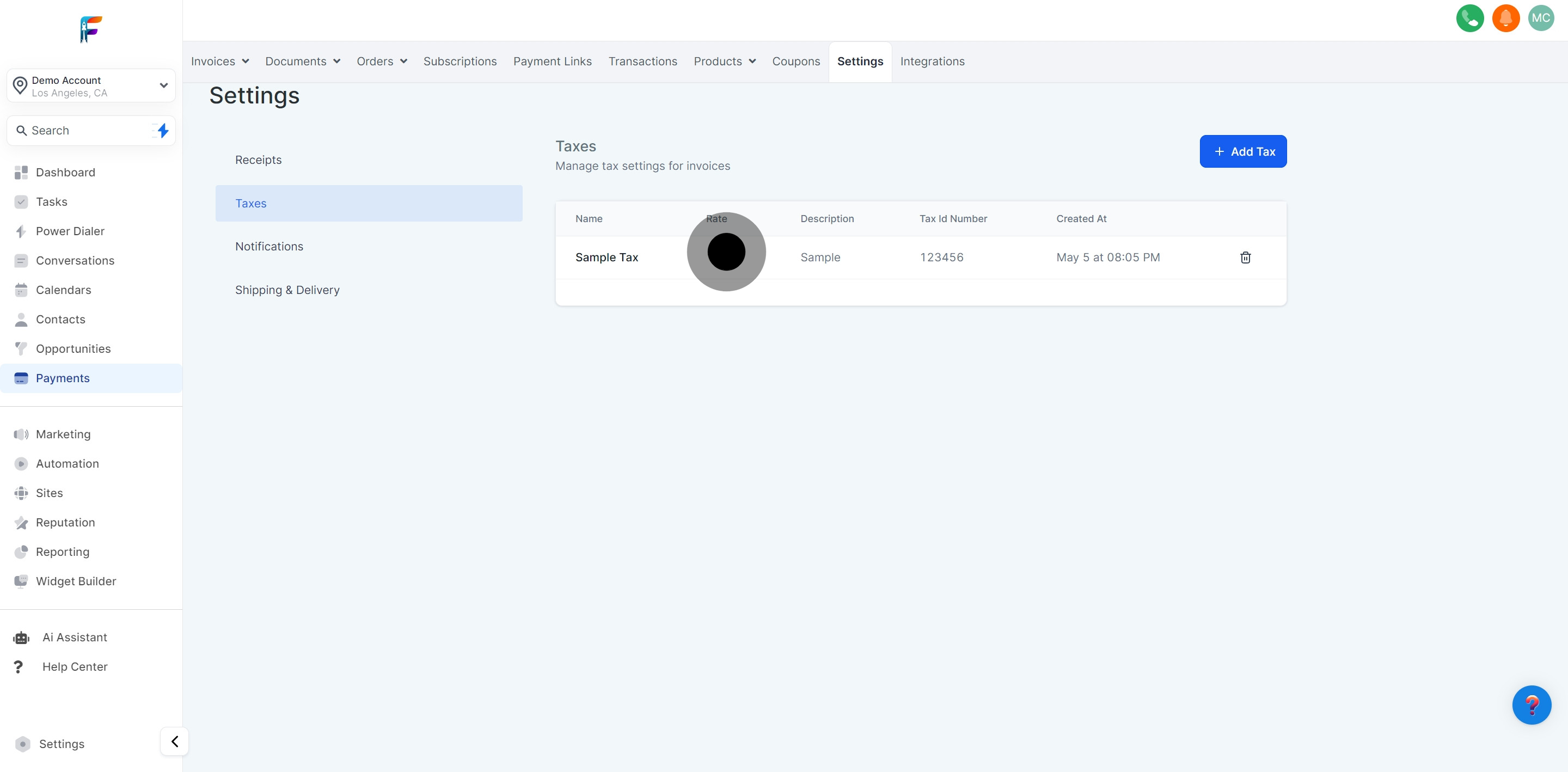

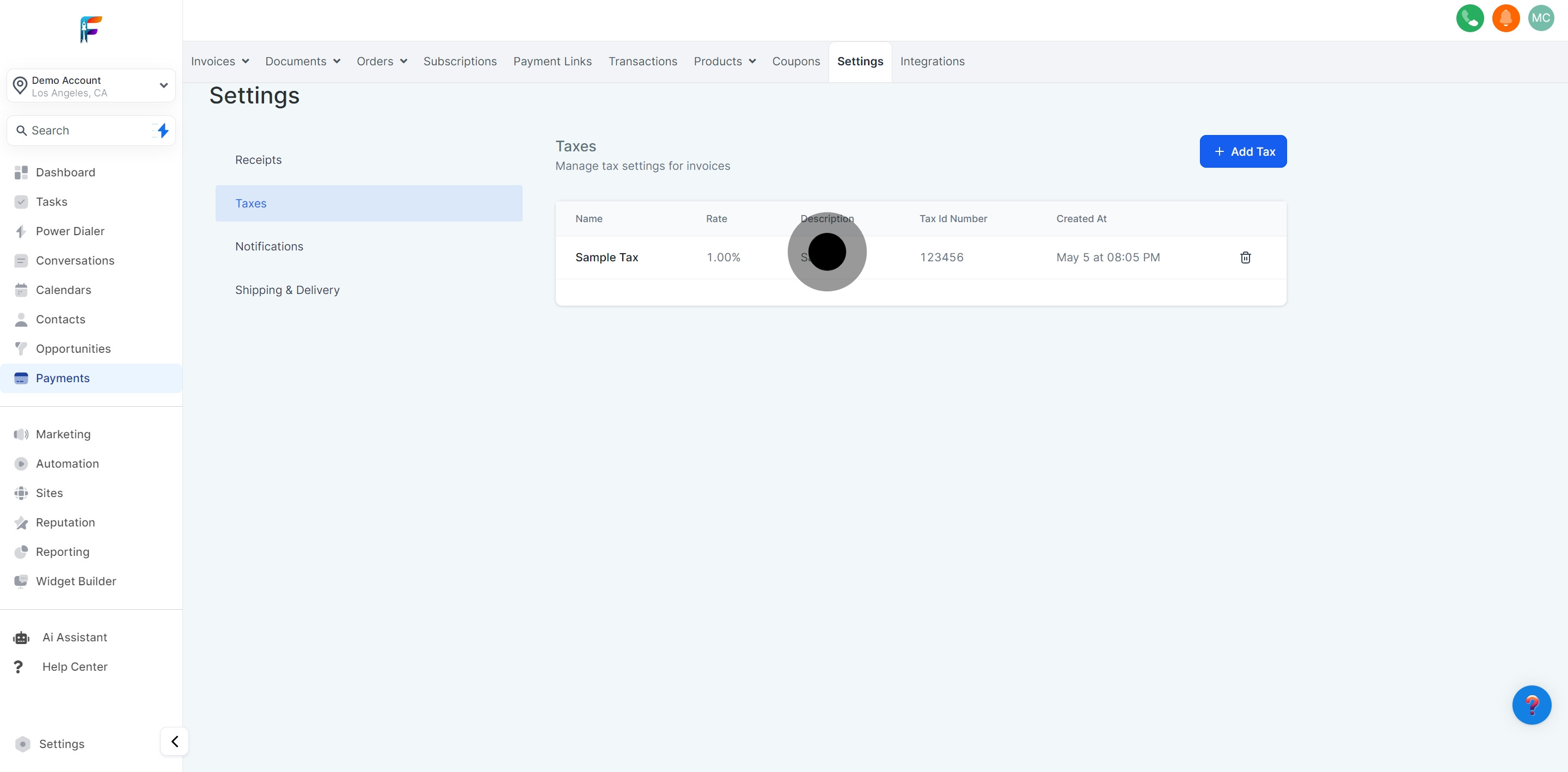

Adjust settings here to customize how taxes are applied to invoices.

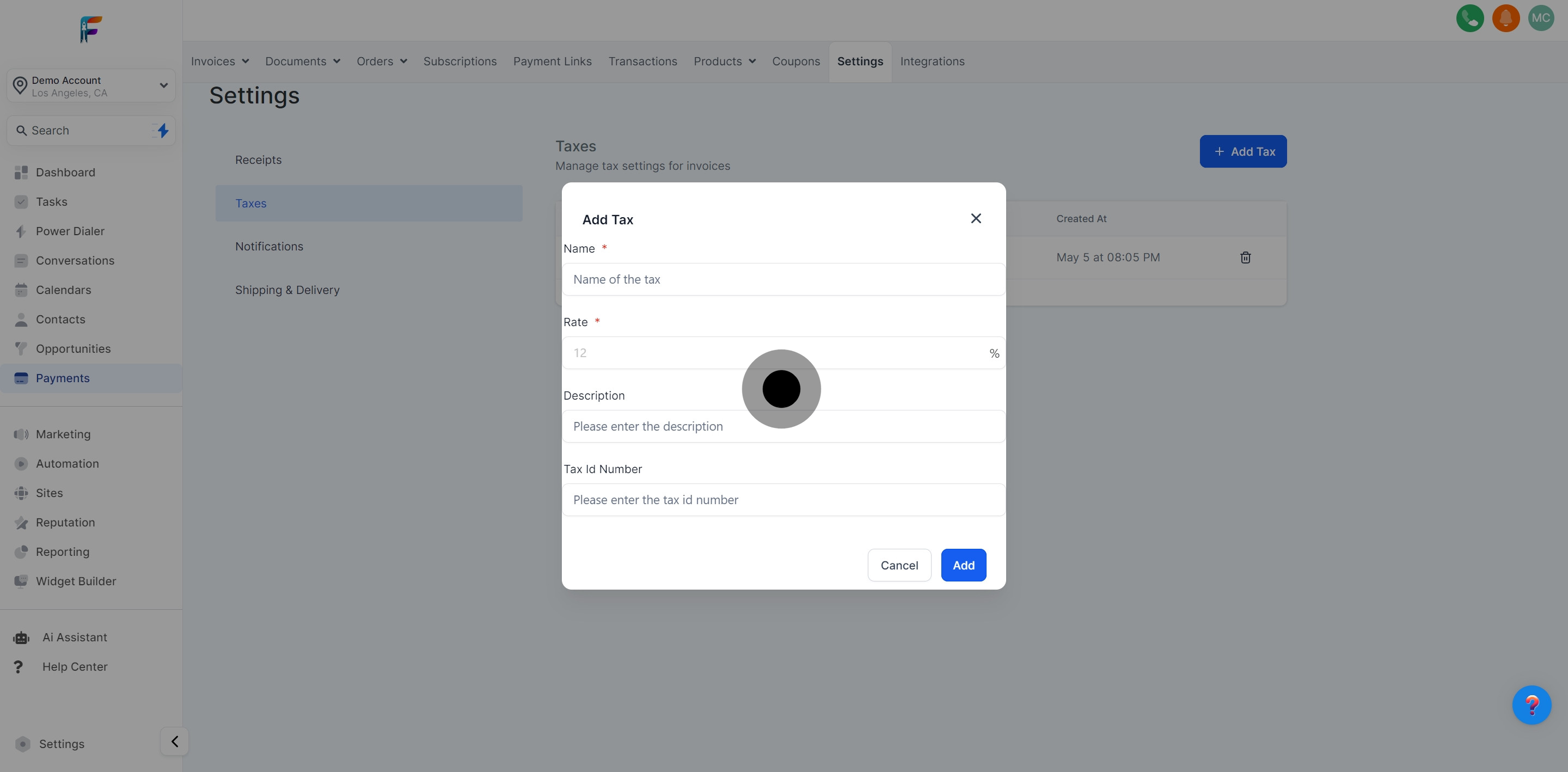

Input the name of the tax as it should appear on invoices and in reports.

In this section, you can view the tax rate you have established for the selected tax, for example, 7.25%.

In this section, you can review the details you've entered for each tax. Below is a sample description for reference:

Tax Description: Statewide Sales and Use Tax at 7.25%, inclusive of 1.25% local taxes (1.00% for Local Jurisdiction and 0.25% for Local Transportation Fund).

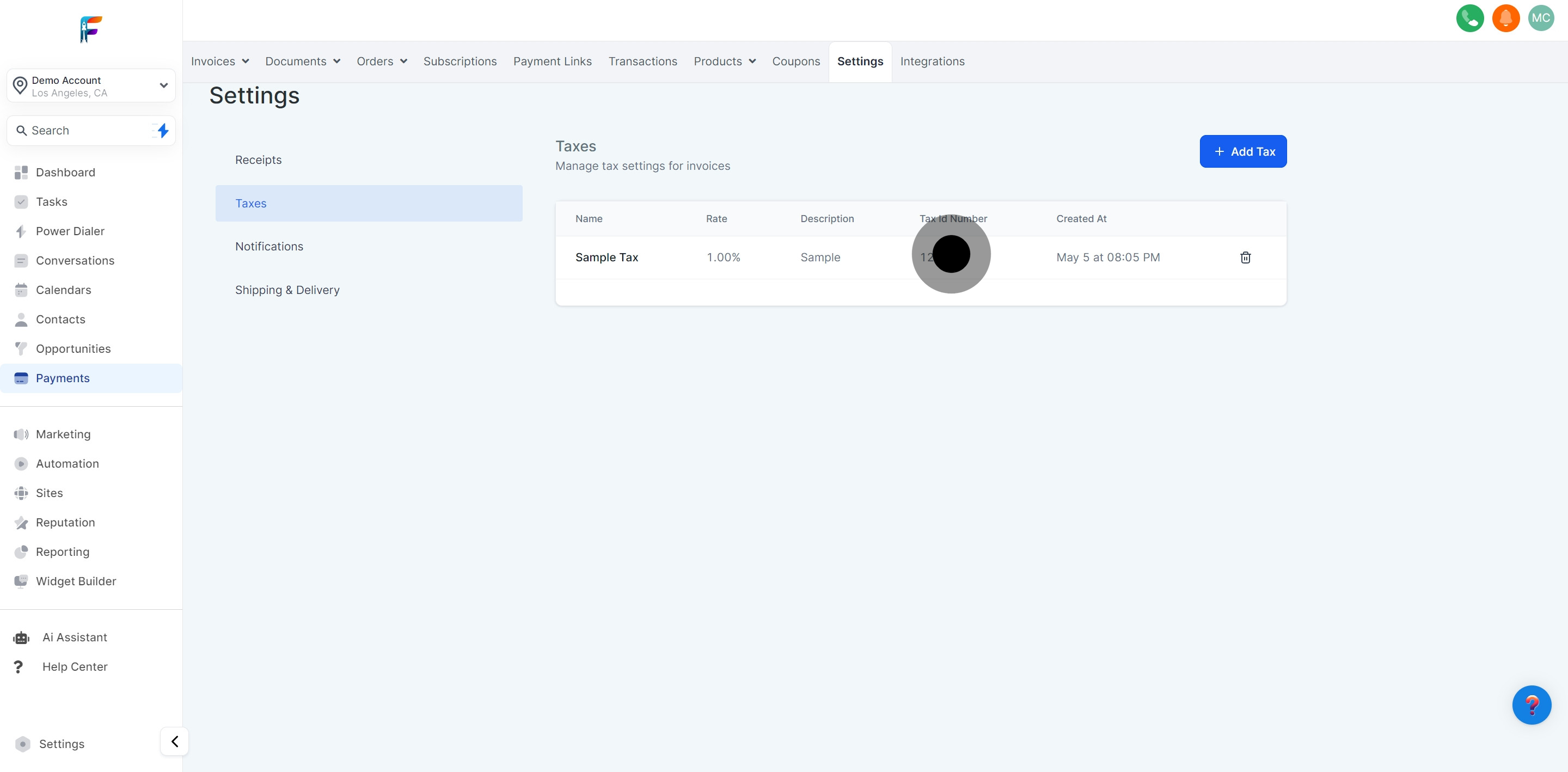

This field displays the unique identification number assigned to each specific tax created in the system. If an ID has not been provided for a particular tax, this field will be left blank.

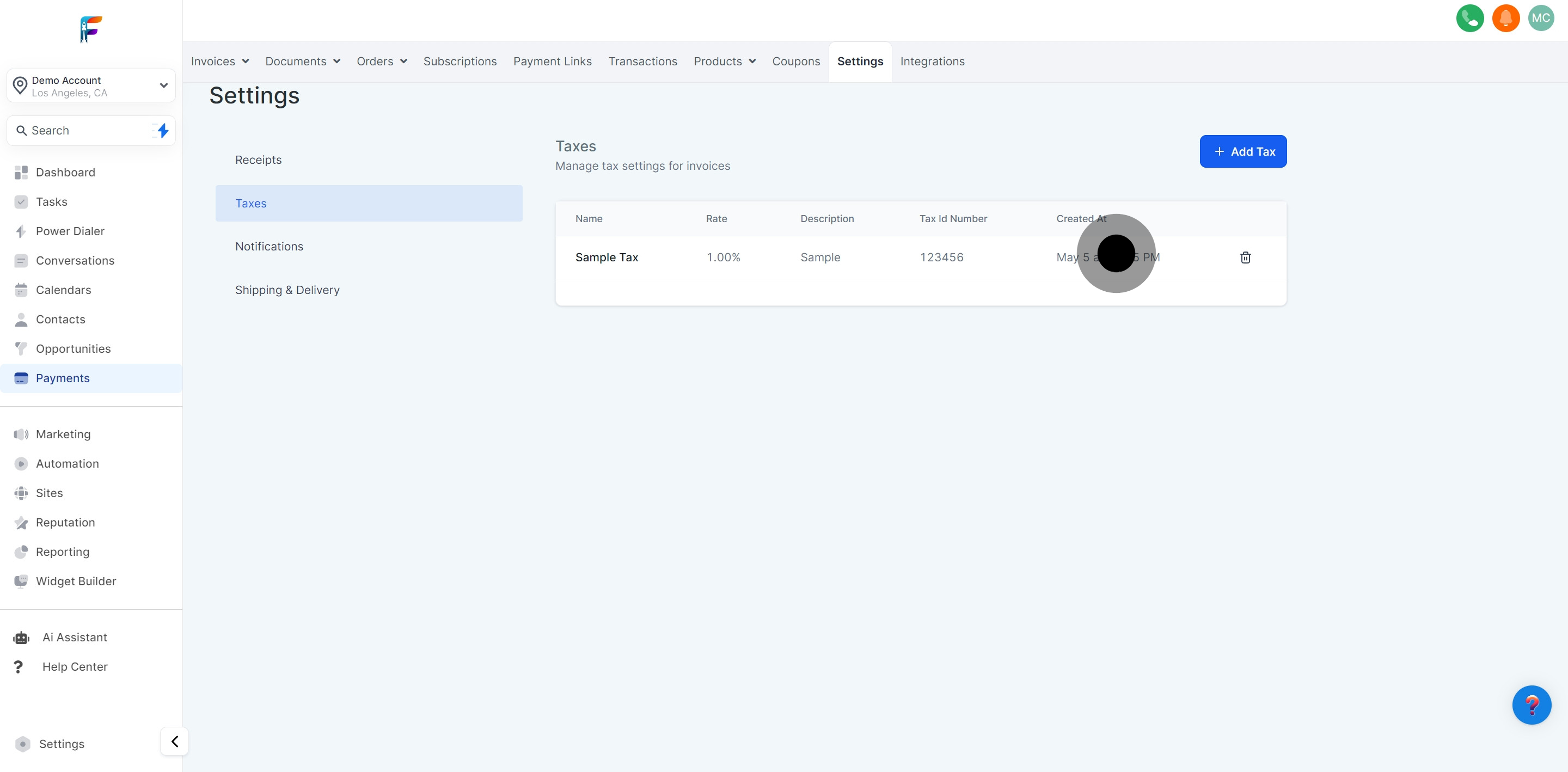

Check the 'Created At' section to see when the tax setting was initially configured.

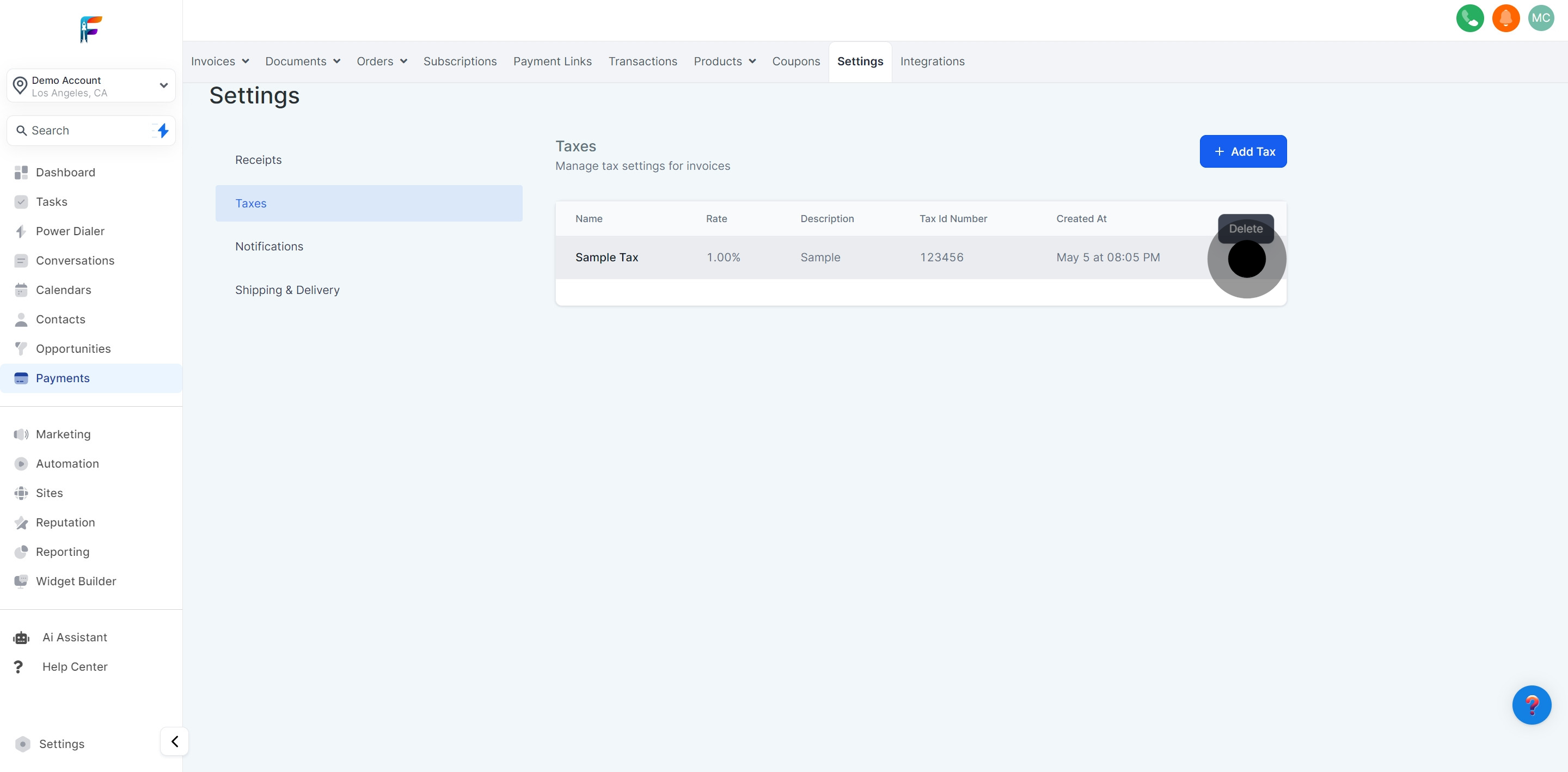

Select 'Add Tax' to input new tax settings if managing multiple tax rates or types.