Some of the features offered by the NMI payment gateway include the following:

Support for multiple currencies and payment methods: NMI supports various currencies and payment methods, allowing businesses to cater to a global audience.

Tokenization and encryption: NMI's platform uses tokenization and encryption technologies to ensure that sensitive cardholder information is securely transmitted and stored, minimizing the risk of fraud and data breaches.

Fraud prevention tools: NMI offers various fraud prevention tools, such as Address Verification System (AVS) and Card Verification Value (CVV), to help merchants identify and block potentially fraudulent transactions.

Customizable checkout experience: Merchants can customize the look and feel of their checkout process to match their branding, ensuring a seamless customer experience.

Recurring billing and subscription management: NMI supports recurring billing and subscription management, making it easy for businesses to offer subscription-based products or services.

Integration options: NMI offers a range of integration options, including APIs and pre-built plugins, making it easy to connect the payment gateway to various e-commerce platforms, shopping carts, and other third-party software.

Reporting and analytics: NMI's platform provides comprehensive reporting and analytics tools that allow merchants to track and analyze transaction data, helping them make informed business decisions.

Customer vault: Merchants can securely store their customers' payment information in NMI's customer vault, simplifying the checkout process for returning customers and making it easy to manage recurring payments.

NMI integration is currently supported for order forms, invoices, and Text2Pay link payments. These steps can enable the integration:

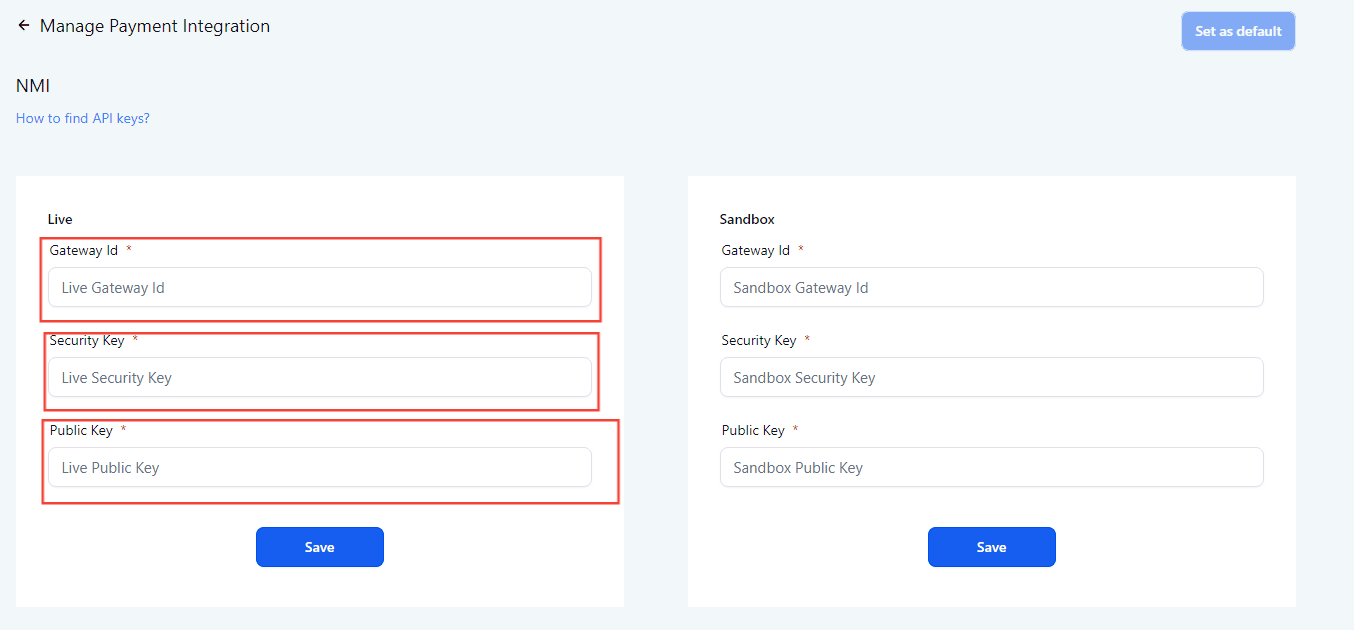

Three keys are required to be entered to connect to NMI:

Gateway Id

Security key

Public key

Please follow these instructions to obtain the keys if you do not already have them:

To get the gateway ID for your account, navigate to your merchant account. Head over to Settings -> Account Information and you will be able to find the Gateway ID for your account.

An application programming interface key (API key) is a unique code that is passed into an API to identify the calling user.

How To Create A Security Key

Log into the Merchant Account

Click on Options

Click on Settings

Click on Security Keys

Types Of Security Keys

API - Used if using Direct Post, Three Step Redirect, or the Query API. (Some plugins may request for this as well)

Cart- Used with our hosted cart also known as Quickclick (https://vimeo.com/202093415)

Tokenization- Used ONLY if you're using Collect.js

** Note: you can check API AND Cart and use it for both.

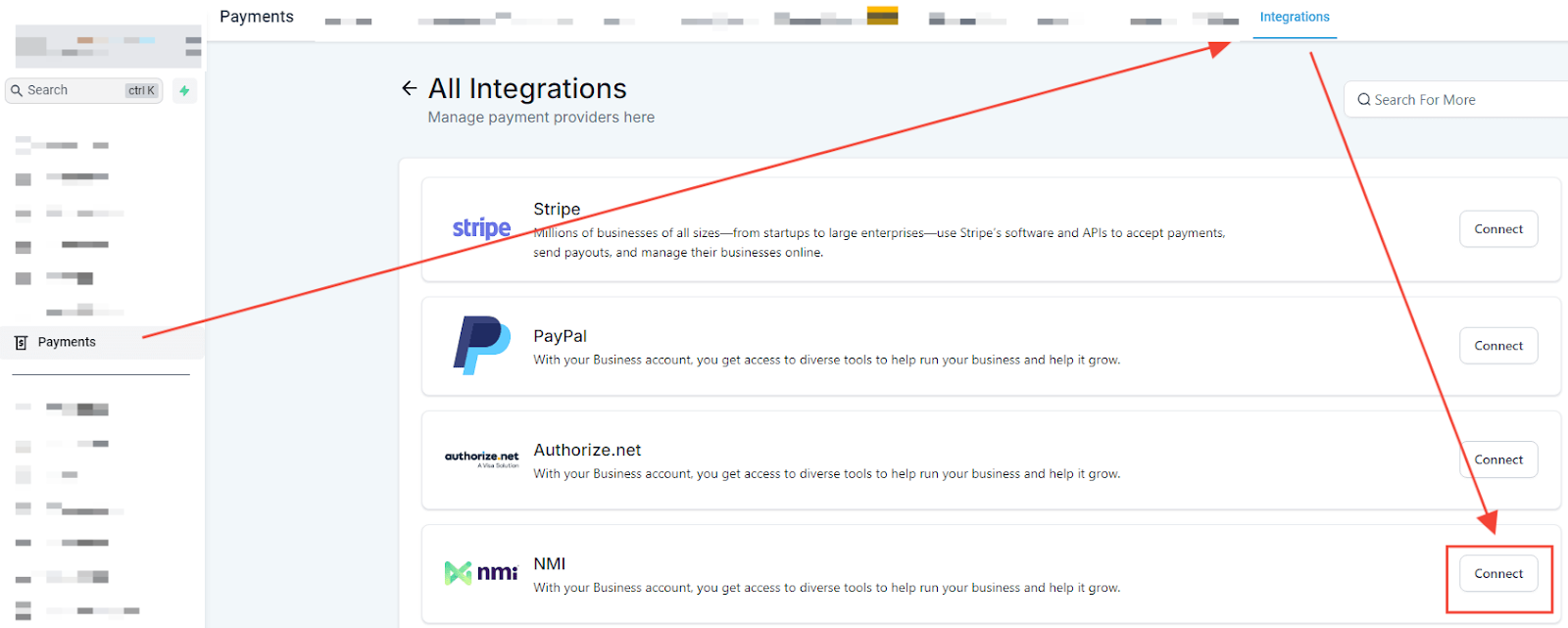

Once you have acquired the keys, please head to Payments> Integrations

Then fill out the respective fields with their keys and then hit Save:

Please Note: Upgrade to funnels version 2 to make use of this feature.

NMI integration for Invoices, Text2pay links, and order form payments

The integration allows the processing of invoices, Text2Pay links, and order form payments using NMI

No new products are required to be created for using NMI, it will work with existing products in place

Other payments from calendars and memberships will continue to be processed via Stripe for now. Please don't set NMI as the default gateway if you are using calendar payments

Supports one-time and recurring payments, one-click upsells along with auto payments in recurring templates

Track all orders and transactions using the Orders and Transactions page under the Payments menu

Ability to cancel a subscription/recurring template created at any time using the Cancel action

Specify the default gateway in case more than 1 gateway is connected

The NMI integration can process order form payments in Funnels version 2. This includes one-step and two-step order forms and one-click upsells; invoice payments can be processed using the NMI integration, and Tex2Pay link payments can be processed using the NMI integration.

Syncing the products is not required at all for using NMI/Authorize.net integration. You are only required to create a product(one-time/recurring) under Payments ➝ Products, and it will work according to the price defined while creating/editing the product.

If existing products are being used with Stripe/Paypal, they will work with Authorize.net or NMI by switching the default provider under Payments ➝ Integrations. No additional sync is required to be done in that case.

Only credit/debit card payments can be accepted using NMI integration. Currently, you cannot accept Apple Pay, Google Pay, or check payment methods,

NO, 3DS payments are not supported using the integration.

Unfortunately, this cannot be the case. Google Pay and Apple Pay can be provided using Stripe only for now, and only one gateway is defaulted for order form payments among Stripe, Authorize.net, or NMI. So using both simultaneously is not possible using NMI as the default gateway.

Yes, recurring product purchases are supported using NMI/Authorize.net integration. You can track the subscriptions under Payments ➝ Subscriptions and orders details under the Orders and Transactions table.

Please Note: Only one recurring product at a time in an order form checkout is supported.

No, You are not required to disconnect Stripe to connect to NMI. You can connect to both gateways on the integrations page. However, since you have connected two gateways for processing payments, you must define a default gateway for processing order form payments.

When you connect to more than one gateway on the Integrations page, you will be required to define a default gateway for processing payments. This is necessary since more than one gateway is eligible to process payments and would require a default choice. One default choice must be made.

Please Note: PayPal will continue to function alongside Authorize.net/Stripe, whichever is set as the default

You can connect to Paypal and use it as a payment method alongside a credit card payment method using Stripe/Authorize.net/NMI. This means that the default must be chosen among Stripe/Authorize.net/NMI when connected. PayPal can be used independently and alongside credit card payment methods on order forms.

The NMI integration is available only for invoices, text2pay links, and order form payments. This means that if NMI is connected and is set as the default gateway, only these payments will be processed through NMI. Other payment areas like calendars, or memberships will continue to process payments using Stripe.

Please Note: If there are any recurring subscriptions/pending transactions with Stripe, they will continue to run as is till the time the Stripe connection is in place. We encourage you to keep the connections in place and not disconnect any gateway, defining the default gateway will run new transactions through the desired choice and will keep in place the existing subscriptions running through Stripe and/or PayPal.

There will be no change in the Orders/Subscriptions/Transactions reporting. All the payments done via NMI/Authorize.net will be available under Payments ➝ Transactions.

Also, there will be no change in the functioning of triggers/attribution associated with order forms. All the functionalities will work the same.

Subscriptions created using NMI/Authorize.net can be canceled within the Subscriptions page using the 'Cancel Subscription' action.

We do not create subscriptions using the Automatic Recurring Billing of NMI/Authorize.net; hence, only charges corresponding to a subscription transaction will be visible in the merchant portal.

No, as of now, we do not have the refund functionality within the application. It would be best if you used the merchant portal for refunding transactions for now.

All subscriptions created on the order forms can be tracked under Payments ➝ Subscriptions. The following represents subscription statuses and their inferences:

Pending - When the first transaction for the subscription could not be completed, or the transaction is held for review

Trial - Subscription is in trial mode

Active - Last payment was made, and there is an upcoming payment as well

Expired - All the subscription payments have been completed, and the subscription no longer exists

Canceled - The business canceled the subscription using the Cancel action, and no further payments will be processed.

Unpaid - The last payment for the subscription was not paid successfully. The subscription is ongoing, but the final payment was unsuccessful.

The following actions will be provided for the subscriptions according to the status:

Actions / StatusPendingTrialActiveExpiredCanceledUnpaidCancelNoYesYesNoNoYes

The following flow describes the handling of subscription statuses and payment retry logics in case of a subsequent payment failure:

If the first subscription payment is successful while purchasing the subscription on the order form, the subscription will move into the active state. It can also move into the trial status if a trial period is attached to the recurring product. The subscription will remain active until every recurring payment is made successfully for the subscription and will move to "Expired" after the completion of payments.

The payment will be attempted two more times after 24 hrs each. The status will remain "Unpaid."

The subscription will remain in the Unpaid state and attempt the following subsequent transactions, each with two retries. The next subsequent payment will also be attempted, and if any payment becomes successful, the subscription will move into "Active." Else will stay with "Unpaid" status.

The subscription status will move to "Expired" after all the retries are made for the last transaction.

If the business disconnected the gateway account and there is an ongoing subscription, the transaction cannot be processed, and hence the subscription will move to unpaid. The retry attempts will continue according to the retry logic.

NMI integration will be available for calendar payments soon. Other areas like memberships will continue to process payments via Stripe.